Risk Management

Policy and Concept

As a material issue, we have identified the need to strengthen the risk management framework for the Group. The Tokyo Tatemono Group seeks to appropriately manage risks that affect the Group's business to achieve stable improvement in corporate value. With this in mind, we have established related regulations and created a risk management framework, and we are working to carry out ongoing risk monitoring and control.

System

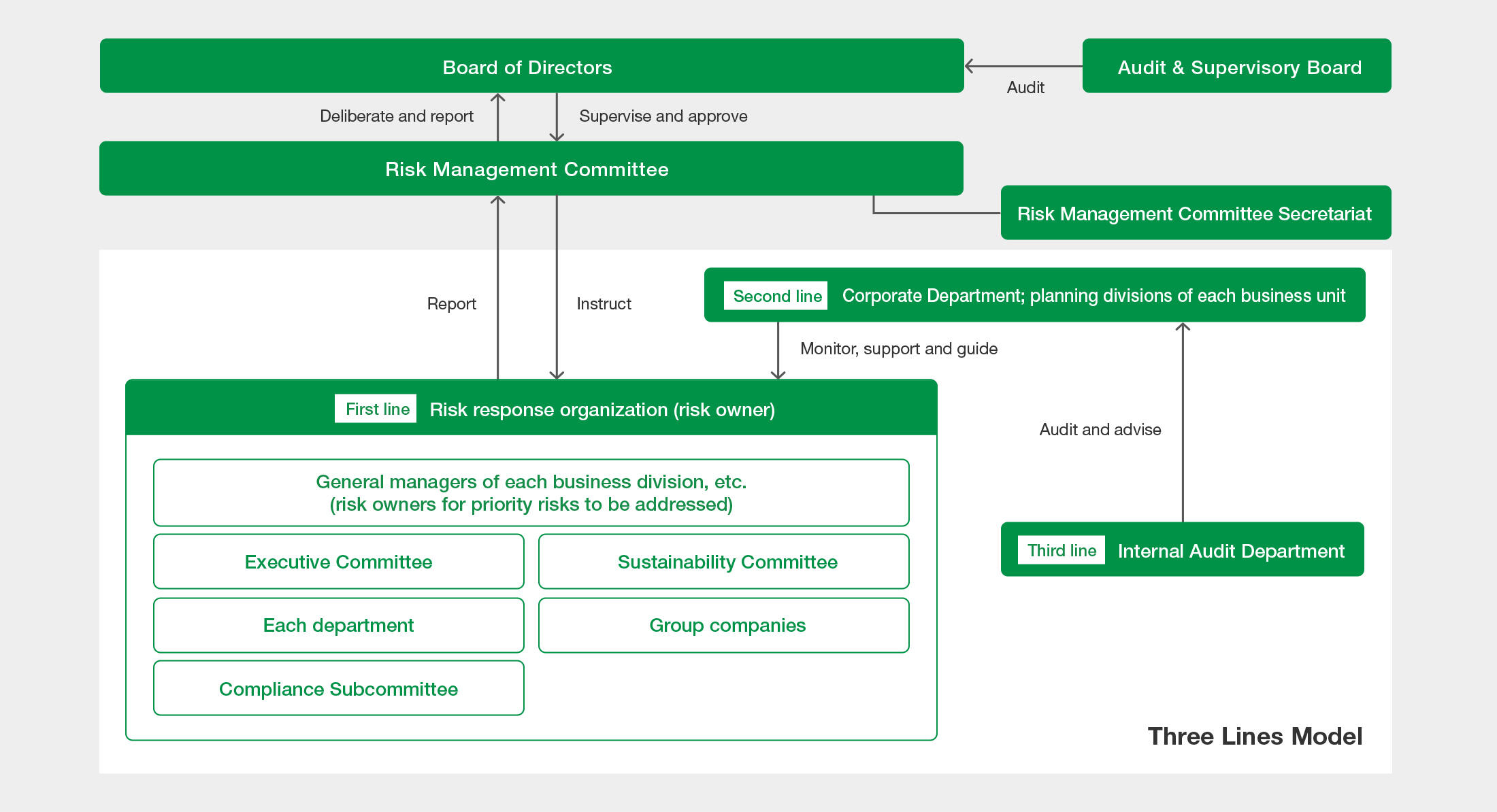

In promoting risk management, we manage the Group's risks in an integrated manner in accordance with our Risk Management Regulations. To this end, we have designated the President and Chief Executive Officer as the Chief Risk Management Officer and established a Risk Management Committee chaired by the President and Chief Executive Officer.

The Committee formulates an annual risk management plan, evaluates and analyzes key management risks for the Group (priority risks), formulates preventive measures and counter- measures, periodically monitors the status of countermeasures, and matters discussed and reported by the Risk Management Committee are placed on the agenda or reported to the Board of Directors, , and the Board of Directors supervises the Committee.

Regarding risks other than priority risks for countermeasures (departmental management risks), each department general acts as a Risk Management Officer as defined in the Risk Management Regulations, appropriately takes preventive mea- sures against and manages departmental management risks.

The Corporate Department and the Business Division Planning Department monitor, support, and provide guidance on risk management at each division and office, while the Internal Audit Department audits and advises on the policies and content of risk management.

In developing our risk management framework, we refer- enced ISO 31000 (international standard for risk management), ERM and the Three Lines Model approach.

Risk Management Structure