Environment

KPIs and Targets

Environmental Management

Related Material Issues

-

Contributing to a safe and secure society

-

Wellbeing

-

Addressing the diverse needs of customers and society

-

Social implementation of technology

-

Promoting a decarbonized society

-

Promoting a recycling-oriented society

Policy and Concept

The Tokyo Tatemono Group aims to contribute to the development of a sustainable society through environmentally friendly business activities in accordance with its Group Environmental Policy. We have identified promoting a decarbonized society and promoting a recycling-oriented society as material environmental issues for the Group. To address these issues through our business operations, we will aim to realize coexistence with the earth and the environment, a shared value with society.

Group Environmental Policy Established January 2011

We will help build a sustainable society through environmentally friendly business activities based on the following Group Environmental Policy.

-

Creating a pleasant city and living with greenery

We will create a rich and comfortable environment for earth and people by utilizing the strength of greenery as much as possible with consideration to biodiversity.

-

Climate change prevention that leads the community

We will actively implement environmentally friendly technologies and ideas into our products and services to lead the community in building a low-carbon city.

-

Resource-saving activities that are kind to the earth

We will strive to reduce the use of resources and environmental impact through all available opportunities and contribute to creating a recycling-oriented society.

-

Developing employees with high environmental awareness

We will comply with laws related to the environment and educate and raise the awareness of our employees about the environment.

Environmental Promotion System

The Tokyo Tatemono Group promotes environmental measures across the entire Group under the Sustainability Committee, chaired by our president, and the Sustainability Promotion Committee, a subordinate organization of the Sustainability Committee.

We have established environmental management systems tailored to the characteristics of each of our businesses. We have put in place a PDCA cycle based on these systems. In the Commercial Properties Business, which accounts for 99.1% of the energy used in our business activities, we established the Environmental Measures Promotion Group. This group operates as a specialized department within the business division's Planning Department. We also hold meetings of an Environmental Committee with the participation of all departments in the business division. In the Residential Business, which accounts for 0.5% of the energy used in our business activities, we have launched an Environmental Measures Project Team. In this way, in both business divisions, we formulate environmental measures, share information, support implementation, provide guidance, progress and carry out improvements to initiatives.

Other businesses and group companies are advancing their businesses according to environmental guidelines established in line with the Group Environmental Policy.

Actions

Promoting a decarbonized society

Related Material Issues

-

Addressing the diverse needs of customers and society

-

Social implementation of technology

-

Promoting a decarbonized society

Policy and Concept

Global efforts toward decarbonization are accelerating, as shown by the Paris Agreement adopted by the United Nations in 2015 and the Glasgow Accord adopted at COP26 in 2021, which calls for efforts to limit the temperature increase to 1.5°C. In 2021, the Japanese government also declared its aim to achieve carbon neutrality by 2050.

Realizing a decarbonized society is an issue that calls for global solutions. The real estate industry must also strive to reduce greenhouse gas (GHG) emissions deriving from real estate holdings and business activities. The Tokyo Tatemono Group further believes that the intensification of wind, flooding, and other natural disasters owing to GHG emissions could have a significant impact on the assets it owns. From this perspective as well, we recognize the need to prioritize this issue.

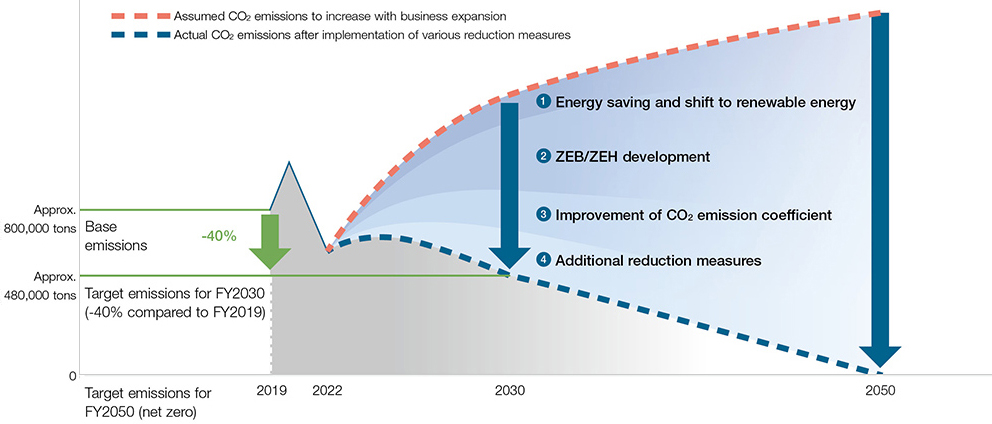

The Tokyo Tatemono Group Environmental Policy calls for us to lead the community in the prevention of global warming. In addition, we have identified promoting a decarbonized society as a material issue for the Group, and are addressing this issue through our business we set medium-and long-term target for reduction in GHG emissions, aiming to achieve net-zero CO2 emissions by fiscal 2050.

In addition, we have set the shift to renewable energy, promotion of development of ZEB and ZEH, and acquisition of green building certification as process targets.

Since setting each target, the Group has promoted and accelerated its efforts to reduce GHG emissions. As a result, in February 2023, we decided to strengthen our process targets and bring forward the timing for achieving certain targets, which we announced publicly. In addition, based on these revised targets, we put in place a roadmap (action plan) for reducing GHG emissions in the Group toward FY2050.

The roadmap is designed to achieve both sustainable growth of the Group and the promotion of a decarbonized society.

At the same time, in response to climate change risks, we are developing resilient real estate (resistant to wind, flooding,and other natural disasters).

Roadmap for Reducing GHG Emissions

Disclosure Based on TCFD Recommendations

Governance

Chaired by the President, the Group's Sustainability Committee, deliberates, discusses, and reports on important matters such as the identifying climate change risks and opportunities, GHG emission reduction targets and policies, and the status of our efforts to address these issues. Important matters discussed by the Committee are submitted to the Board of Directors or reported to the Board of Directors, which has oversight over the Committee. In addition, the Sustainability Promotion Council, a subordinate body of the Committee that is composed of corporate and business divisions, discusses matters to be brought before the Committee, considering specific measures for achieving the goals that have been set through discussions at the Committee.

Strategy (scenario analysis)

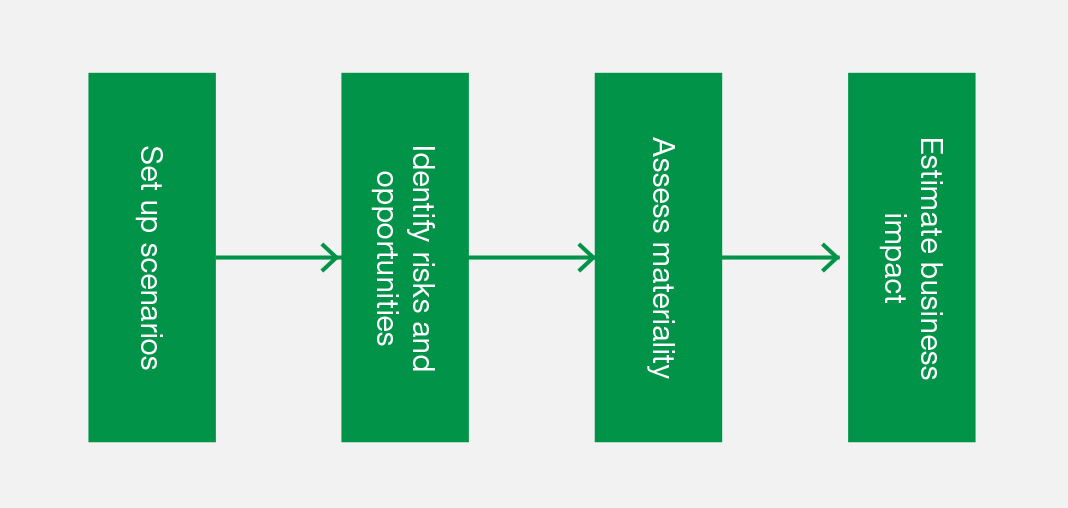

We carry out a scenario analysis, led by the Sustainability Committee, in collaboration with corporate and business divisions. This examines the potential impact of climate change itself and changes in the business environment due to long-term policy trends related to climate change on our group's business and management.

Risk Analysis Review Process

Setting Up the Scenarios

For our scenario analysis, we set up future worlds (scenarios). In 2020, drawing from scenarios published by the IPCC*1 and the IEA*2, we based our analysis on two scenarios: the 4°C scenario, in which the average temperature rises by 4°C or more compared to preindustrial levels by 2100, and the 2°C scenario, in which the average temperature rise is limited to less than 2°C. In 2022, we added the 1.5°C scenario, which limits the increase in average temperature to 1.5°C.

-

IPCC (Intergovernmental Panel on Climate Change): an institution that provides clear scientific opinions of the status of climate change and its socioeconomic impact.

-

IEA (International Energy Agency): an independent body within the OECD that facilitates policy cooperation on energy security and energy.

The Scenarios Used in the Analysis

| Scenarios | Scenario Content | Reference Scenario |

|---|---|---|

| 4°C scenario | A scenario in which the average temperature rises by about 4°C compared to pre-industrial levels as a result of failure to introduce stricter government policies and strengthen regulations, such as regulations to curb GHG emissions, and of failure by businesses to take effective action in response to climate change. Acute effects include more frequent extreme weather events and more intense heavy rainfall, while chronic effects include rising sea levels. | IPCC SSP5-8.5 (RCP 8.5) IEA STEPS |

| Scenarios | Scenario Content | Reference Scenario |

|---|---|---|

| 1.5C/2°C scenario | A scenario in which the average temperature rise compared to the pre-industrial levels is kept below 1.5°C or 2°C by improving low-carbon technologies, expanding renewable energy, and promoting energy conservation. In this scenario, companies around the world are strongly required to respond to climate change by introducing carbon taxes and strengthening policies to regulate emissions in order to curb GHG emissions. | IPCC SSP1-1.9 (RCP 2.6) IEA NZE IEA SDS |

Identifying Risks and Opportunities/Assessing Materiality

Focusing on the Group's core businesses, the Commercial Properties Business and Residential Business, we identified the main risks and opportunities and assessed their materiality in terms of their expected degree of impact on the Group's finances. The period of impact was categorized into short-term (1-5 years), medium-term (5-10 years), and long-term (>10 years).

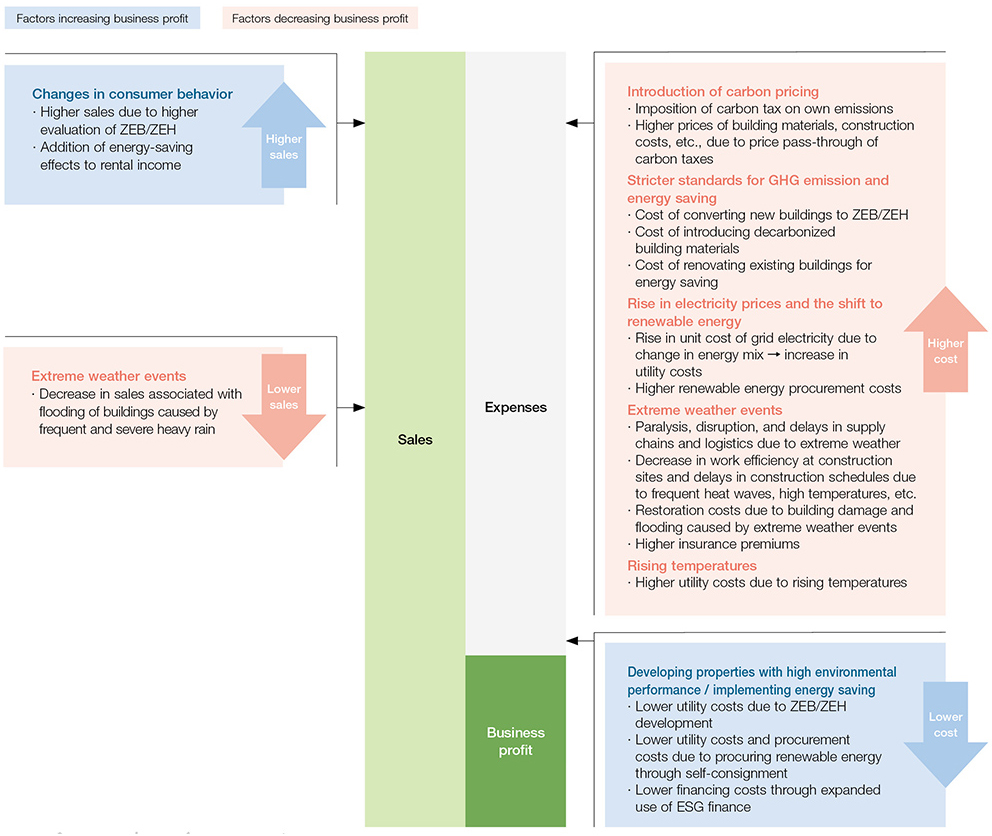

Estimating Business Impact

We quantitatively assess the identified climate change risks and opportunities for their impact on the Group's 2030 financials.

For risks and opportunities for which quantitative data is not readily available, we carry out a qualitative analysis.

Identified Climate Change Risks and Opportunities and Materiality

| Category | Item | Impact on Group business | Period of impact | Materiality | ||

|---|---|---|---|---|---|---|

| 4°C scenario | 1.5°C/2°C scenario | |||||

|

Transition risk |

Policies |

Adoption of carbon pricing |

Imposition of carbon tax on own emissions (Scope 1 and 2) |

Medium-term |

ー |

Medium |

|

Price hikes for construction materials, construction costs, etc. |

Medium-term |

ー |

Medium |

|||

|

Regulations |

Stricter standards for GHG emissions and energy saving |

Higher costs of converting new buildings to ZEB/ZEH |

Medium-term |

Low |

Low |

|

|

Higher costs of introducing decarbonized building materials |

Medium-term |

Medium |

Medium |

|||

|

Increase in cost of energy-saving renovation of existing buildings |

Medium-term |

Low |

Low |

|||

|

Technology and Markets |

Higher unit cost of grid electricity |

Higher utility costs due to change in energy mix |

Short- to medium-term |

ー |

Low |

|

|

Higher utility costs due to higher demand for fossil fuels |

Short- to medium-term |

Low |

ー |

|||

|

Burden from renewable energy procurement |

Higher renewable energy procurement costs |

Short- to medium-term |

Low |

Low |

||

|

Reputation |

Ensuring disaster preparedness and resilience |

Higher costs of ensuring disaster preparedness and resilience |

Short-term |

Low |

Low |

|

|

Physical risks |

Acute |

Frequent and intense extreme weather events |

Delayed construction schedule due to supply chain paralysis or disruption |

Short-term |

ー |

ー |

|

Costs arising from countermeasures and construction period delays |

Short-term |

ー |

ー |

|||

|

Loss of rental income in the event of flooding |

Short-term |

Low |

Low |

|||

|

Restoration costs arising from building damage and flooding |

Short-term |

Low |

Low |

|||

|

Higher insurance premiums |

Short-term |

Low |

Low |

|||

|

Chronic |

Rise in average temperature |

Higher utility costs |

Short-term |

Low |

Low |

|

|

Opportunity |

Technology |

Efficiency Improvements with ZEB and ZEH Development |

Reduction of utility costs |

Short-term |

Low |

Low |

|

Procurement of renewable energy through self-consignment |

Reduction in utility costs and renewable energy procurement costs |

Short-term |

Low |

Low |

||

|

Consumer behavior |

Improved earnings from high environmental performance properties |

Higher sales due to higher evaluation of ZEB/ZEH |

Short- to medium-term |

ー |

Medium |

|

|

Improvement of energy-saving effects |

Addition of energy-saving effects to rental income |

Short- to medium-term |

ー |

Low |

||

|

Markets |

Expansion of ESG Finance |

Reduction in financing costs |

Short-term |

ー |

Low |

|

Risk Management

We have established a Risk Management Committee chaired by the President, which is responsible for overseeing risk management for the Tokyo Tatemono Group. The Risk Management Committee identifies important risks that could have a significant impact on the management of the Group, evaluates and analyzes the relevant risks, formulates preventive measures and countermeasures, and monitors the status of countermeasures. The Committee also submits regular reports to the Board of Directors, which oversees its activities.

Recognizing climate change risk as one of the most significant risks, we have established a PDCA cycle for risk management. The Sustainability Committee considers various policies and strategies for minimizing risk and seizing opportunities, and other risk management issues. The Sustainability Promotion Council, a subordinate body of the Sustainability Committee, monitors climate change-related measures flexibly to consider and implement effective countermeasures. In this way, we consider and carry out effective measures and review risks and opportunities in an appropriate manner.

Impact on the Group's Business Profit

Indicators and Targets

Recognizing the importance of reducing GHG emissions to minimize the risk of climate change, the Tokyo Tatemono Group has included medium- and long-term targets for reducing GHG emissions in our KPIs and targets. We conduct quantitative monitoring of GHG emissions and announce the results of this monitoring.

In addition, we have set a short-term target of reducing our energy consumption per unit of production by 1% each year on a five-year moving average basis. As medium- to long-term goals for GHG emissions reduction, we have set the following targets: a 40% reduction of CO2 emissions by FY2030 compared to FY2019; and net zero CO2 emissions by FY2050.

We have also established process targets for introducing renewable energy, promoting ZEB/ZEH development, and acquiring Green Building Certification. Going forward, we will continue to work to further conserve energy and reduce our environmental impact.

Actions

External Evaluation and Certification for Green Building

Related Material Issues

-

Strengthening Tokyo's competitiveness as an international city

-

Addressing the diverse needs of customers and society

-

Revitalizing and utilizing real estate stock

-

Promoting a decarbonized society

Policy and Concept

The Tokyo Tatemono Group recognizes that, to meet the expectations and demands of our tenants, investors, and other stakeholders, it is essential both to develop and operate real estate with high environmental and social awareness and to make open disclosure of our performance and initiatives related to such real estate.

We have identified promoting a decarbonized society as a material issue for the Group. To address this issue through our business operations, we have established a KPI and target of, in principle, acquiring green building certification* for all newly constructed office buildings, logistics properties, and for-rent condominiums. We also have a policy of acquiring environmental certification as far as possible for existing office buildings and for-rent condominiums.

* DBJ Green Building Certification, CASBEE Building, etc.

Properties with Green Building Certification (as of December 31, 2022)

| DBJ Green Building Certification | ||

|---|---|---|

| Evaluation | Year of acquisition/renewal |

Property Name |

| ★★★★★ | 2020 |

Hareza Tower |

| 2022 |

Otemachi Tower |

|

| 2022 |

Tokyo Square Garden |

|

| 2022 |

Nakano Central Park South |

|

| 2022 |

SMARK Isesaki |

|

| 2022 |

Brillia ist Tower Kachidoki |

|

| 2022 |

Brillia ist Nakano Central Park |

|

| ★★★★ | 2020 |

Tokyo Tatemono Yaesu Building |

| 2020 |

Osaki Center Building |

|

| 2021 |

Empire Building |

|

| 2021 |

Tokyo Tatemono Sendai Building |

|

| 2021 |

Shinjuku Center Building |

|

| 2022 |

Tokyo Tatemono Nihonbashi Building |

|

| 2022 |

Tokyo Tatemono Shijo-Karasuma Building EAST |

|

| ★★★ | 2021 |

Yokohama First Building |

| 2021 |

Nihonbashi TI Building |

|

| 2022 |

Shijo-Karasuma FT Square |

|

| 2022 |

Tokyo Tatemono Umeda Building |

|

| 2022 |

Brillia ist Machiya |

|

| 2022 |

Brillia ist Shibuya Honmachi |

|

| 2022 |

Brillia ist Ueno |

|

| 2022 |

Brillia ist Akabane |

|

| BELS*1 | |||

|---|---|---|---|

| Evaluation | Year of acquisition |

Property Name | ZEB/ZEH*2 |

| ★★★★★ | 2018 |

Brillia Tsurumaki |

ZEH-M Oriented |

| 2019 |

Hareza Tower (Office Section) |

ZEB Ready | |

| 2020 |

Brillia Tower Seiseki Sakuragaoka BLOOMING RESIDENCE |

ZEH-M Oriented | |

| 2021 |

Tokyo Tatemono Shijo-Karasuma Building EAST |

ZEB Ready | |

| 2021 |

T-LOGI Narashino |

『ZEB』 | |

| 2022 |

T-LOGI Yokohama-Aoba |

『ZEB』 | |

| 2022 |

T-LOGI Fukuoka |

『ZEB』 | |

| 2022 |

T-LOGI Narashino II |

『ZEB』 | |

| 2022 |

T-LOGI Ayase |

『ZEB』 | |

| 2022 |

T-LOGI Kazo |

『ZEB』 | |

| ★★★★ | 2021 |

Shijo-Karasuma FT Square (Office Space) |

― |

| ★★★ | 2016 |

Otemachi Tower |

― |

| ★★ | 2018 |

Empire Building |

― |

| CASBEE*3 Building (New) | ||

|---|---|---|

| Evaluation | Year of acquisition |

Property Name |

| S rank | 2019 |

Hareza Tower |

| 2021 |

Tokyo Tatemono Shijo-Karasuma Building EAST |

|

| 2022 |

T-LOGI Ayase |

|

| A rank | 2020 |

T-LOGI Yokohama-Aoba (CASBEE Yokohama) |

| 2022 |

T-LOGI Narashino |

|

| 2022 |

T-LOGI Narashino II |

|

| 2022 |

T-LOGI Kazo |

|

| CASBEE*3 Real Estate | ||

|---|---|---|

| Evaluation | Year of acquisition/renewal |

Property Name |

| S rank | 2020 |

Nagoya Prime Central Tower |

| CASBEE*3 Wellness Office | ||

|---|---|---|

| Evaluation | Year of acquisition/renewal |

Property Name |

| S rank | 2021 |

Tokyo Tatemono Yaesu Building |

| 2022 |

Tokyo Tatemono Shijo-Karasuma Building EAST |

|

| A rank | 2022 |

T-PLUS Nihonbashi Kodenmacho |

| ABINC Certification*4 (Association for Business Innovation in harmony with Nature and Community® Certification) |

|

|---|---|

| Year of acquisition/renewal |

Property Name |

| 2020 |

Otemachi Tower |

| 2021 |

Tokyo Square Garden |

| SEGES certification*5 (Urban Oasis) | |

|---|---|

| Year of acquisition/renewal |

Property Name |

| 2021 |

Otemachi Tower |

| 2022 |

Tokyo Square Garden |

-

BELS (Building-housing Energy-efficiency Labeling System) is a guideline established by the Ministry of Land, Infrastructure, Transport and Tourism to accurately evaluate and display the energy saving performance of nonresidential buildings.

-

ZEB (Net Zero Energy Building) is a building that is designed to achieve a net-zero balance of annual primary energy consumption. ZEH (-M) (Net Zero Energy House (-M)) is a house that is designed to achieve a net-zero balance of annual primary energy consumption.

-

CASBEE (Comprehensive Assessment System for Built Environment Efficiency) is a method for evaluating and grading the environmental performance of structures

-

ABINC Certification is a third-party evaluation and certification system for biodiversity conservation efforts, using the Japan Business Initiative for Biodiversity-developed Association for Business Innovation in harmony with Nature and Community®, Certification Guideline and the Land Use Score Card® as evaluation standards.

-

SEGES Certification is the Social and Environmental Green Evaluation System

Actions

Water Resources

Related Material Issues

-

Contributing to a safe and secure society

-

Promoting a recycling-oriented society

Policy and Concept

As water shortages become even more severe worldwide, developed nations and the rest of the world face demands to continuously improve the efficiency of water consumption. The Tokyo Tatemono Group Environmental Policy includes a call for resource-saving activities that are kind to the earth. We have identified promoting a recycling-oriented society as a material issue for the Group. To address this issue through our business operations, we have established KPIs and targets related to water resources. With regard to reducing water consumption, we aim for a year-on-year water consumption unit load reduction of long-term buildings*. To promote the use of recycled water, we aim to equip, in principle, all new office buildings that have a total floor area of over 30,000m² with gray water treatment facilities by fiscal 2030.

We have set a management plan for water use that applies in principle to all properties we own in commercial properties business, which account for 87.4% of our total leasable space. The amount of water used is monitored monthly for each property. If there is a large increase or decrease compared to the amount used in the same month of the previous year, we check the reason for the increase or decrease. This helps to ensure appropriate water use in the future.

As a developer, Tokyo Tatemono recognize that water resources are an essential element for the continued creation of rich and comfortable spaces. We will strive to reduce the use of resources and lessen environmental impact through all available opportunities including conserving the use of water and recycling rainwater and miscellaneous wastewater.

* 36 major office buildings for which Tokyo Tatemono hast energy managemen authority

Actions

Promoting a recycling-oriented society

Related Material Issues

-

Contributing to a safe and secure society

-

Promoting a decarbonized society

-

Promoting a recycling-oriented society

Policy and Concept

Pollution of the air, soil, and water caused by waste and hazardous substances and the depletion of natural resources are issues shared by all of society. Businesses have an obligation to reduce the waste and hazardous substances generated by their activities and use natural resources effectively.

The Tokyo Tatemono Group Environmental Policy includes a call for resource-saving activities that are kind to the earth. We have also identified promoting a recycling-oriented society as a material issue for the Group. To address this issue through our business operations, we have set KPIs and targets relating to waste emissions from our long-term buildings.* We have set targets for fiscal 2030 of reducing waste emissions by 20% compared to fiscal 2019, and achieving a waste recycling rate of 90%. We are carrying out measures aimed at achieving these targets.

The Group recognizes that we must work to prevent pollution of the air, soil, and water and to use natural resources effectively. We strive to achieve this throughout the entire life cycle of each building, from planning and design to construction, operation and management, as well as demolition. Through these efforts, we are working to reduce our environmental impact.

In the development of buildings, we carry out our planning and design and formulation of construction plans in a way that considers environmental and life-cycle assessments. In operation and management, we strive to reduce waste while curbing and properly managing hazardous substances. In this way, at each of the stages of operation, management, and demolition, we work to prevent air, soil, and water pollution and to use natural resources effectively.

* Our long-term buildings and commercial facilities for which we have substantial energy management authority and for which we have submitted a written plan for waste reuse and reduction.

Actions

Biodiversity

Related Material Issues

-

Promoting a decarbonized society

-

Promoting a recycling-oriented society

Policy and Concept

Real estate development is intrinsically interlinked with local ecosystems and natural environments. We must grasp and reflect upon how we impact our surroundings, both directly and indirectly.

Tokyo Tatemono Group is working toward a vision of creating a pleasant city and living with greenery, a commitment that is included in our Group Environmental Policy. We are striving to create a rich and comfortable environment that takes biodiversity into consideration, such as by maximizing the power of greenery, and transplanting trees on our properties in line with the development plan, and by surveying local vegetation and the distribution of organisms, and selecting tree species to plant.

We have put in place environmental guidelines for all properties we develop and operate in the Commercial Properties Business, and for all properties we develop under our own brand name "Brillia" in the Residential Business. Both sets of guidelines establish policies for greening buildings and sites, using greening to mitigate the heat island effect, preserving biodiversity and ecosystems including links to the surrounding greenery, and using greenery for communication with tenants and residents as well as the surrounding area. Both sets of guidelines also put in place policies of obtaining third-party certifications such as ABINC certification and SEGES for properties where it is possible to implement initiatives of a certain scale.

For initiatives of a certain scale in the Commercial Properties Business, our policy is to undergo assessment by impartial third parties. The organizations that assess our initiatives include ABINC, a third-party certification system for biodiversity conservation, and SEGES, a third-party certification system for green space creation.

Actions

Sustainability Finance

Related Material Issues

-

Strengthening Tokyo's competitiveness as an international city

-

Contributing to a safe and secure society

-

Community building and revitalization

-

Addressing the diverse needs of customers and society

-

Value co-creation and innovation

-

Promoting a decarbonized society

Policy and Concept

Sustainability finance refers to bonds and loans to raise funds specifically for the purpose of promoting sustainability by addressing environmental issues such as climate change or social issues such as poverty, health, and economic disparity.

The Tokyo Tatemono Group promotes urban development that contributes to solving social issues. We strive to improve the attractiveness of the areas in which we develop and to increase the value of our entire portfolio of owned office buildings. We aim to channel these efforts toward our sustainable growth as a company.

In this era of dramatic change and increasing uncertainty, we will accelerate the cycle of allocating the funds we raise to projects that help bring about a sustainable society. We will help promote decarbonized, sustainable society by balancing, at a high level across our operations, the need to address social issues with the need for business growth.

Sustainability Finance Framework

Tokyo Tatemono has put in place several finance frameworks to guide its financing. These frameworks apply the four requirements defined in the Green Bond Principles, Social Bond Principles, Green Loan Principles, and Social Loan Principles referred to by the International Capital Markets Association: Use of Proceeds; Process for Project Evaluation and Selection; Management of Proceeds; and Reporting.

Actions

Responding to Natural Disasters

Related Material Issues

-

Strengthening Tokyo's competitiveness as an international city

-

Contributing to a safe and secure society

-

Community building and revitalization

-

Wellbeing

-

Social implementation of technology

-

Promoting a decarbonized society

Policy and Concept

Natural disasters such as major earthquakes and typhoons threaten our way of life. Climate change has resulted in frequent destructive typhoons and extreme weather in recent years. As a result, interest is rising faster than ever in the safety of real estate, which is a foundation of our lives.

As a real estate services provider, the Tokyo Tatemono Group believes that improving resilience against disasters in ordinary times and providing safety and comfort to our customers and other stakeholders are important responsibilities.

We have identified contributing to a safe and secure society as a material issue for the Group. To address this issue through our business operations, we will continue to further strengthen our measures against natural disasters.

Responding to Natural Disasters

Preparing for Natural Disasters with Fire Brigade Training, Disaster Drills, and First-Aid Courses

As part of our soft measures for disaster prevention, the Tokyo Tatemono Group hosts fire-fighting and other training and courses to enhance the ability of our employees to respond to disasters.

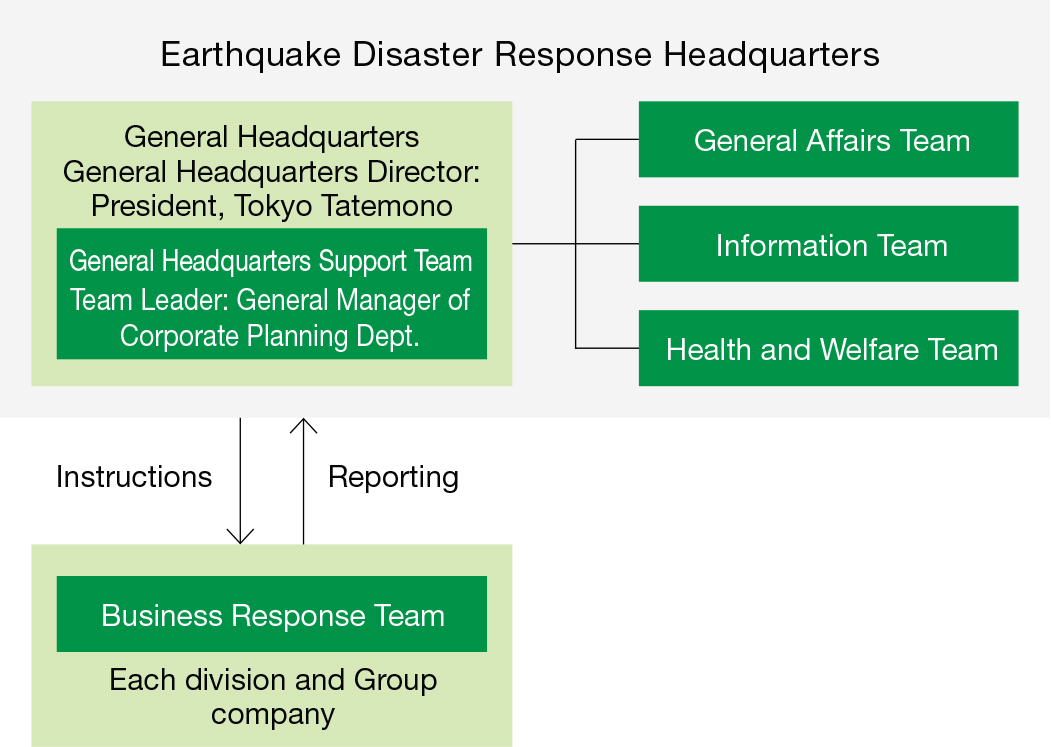

The Tokyo Tatemono Group has established a basic policy for earthquake response, called the Basic Plan for Earthquake Measures. We have prepared manuals for initial response, stockpiling, and employee safety confirmation. Each October, group companies conduct joint drills on earthquake response measures to confirm chain of command, division of responsibilities, information gathering and communications, and employee safety confirmation.

In 2022, we conducted a training exercise that envisaged the immediate aftermath of an earthquake. In the training, our disaster information sharing tool was to report from each disaster countermeasures headquarters and each operational task force to the disaster countermeasures general headquarters. We also held workshop exercises through which each disaster countermeasures headquarters and each operational task force considered how to respond to hypothetical scenarios in the event of a disaster.

Earthquake Disaster Response Headquarters Organization Chart